Tell us more about the Petrofac operating model. What is it, and how does it set Petrofac apart?

Our model is fundamentally different from other energy services businesses. There are four things which, in combination, make us unique:

First, as an integrated services operator, we don’t try to do everything ourselves. Instead, we coordinate and choreograph the work of an extended supply chain, sourcing and managing the best and most cost-effective solution for every client, spanning the entire asset lifecycle.

Second, we have an operations mindset. Managing facilities and delivering consistent operational improvements is what we do and how we think. Whenever we deliver any plan repairs or equipment upgrades, we always think through the operational and production implications. By contrast, many of our competitors are project-based contracting businesses.

Third, we have a local delivery model. Wherever we work, we aim to employ local people, nurture local supply chains, and develop local talent and capabilities. This, in turn, helps us reduce costs, de-risk delivery, and build strong, long-term relationships with local stakeholders.

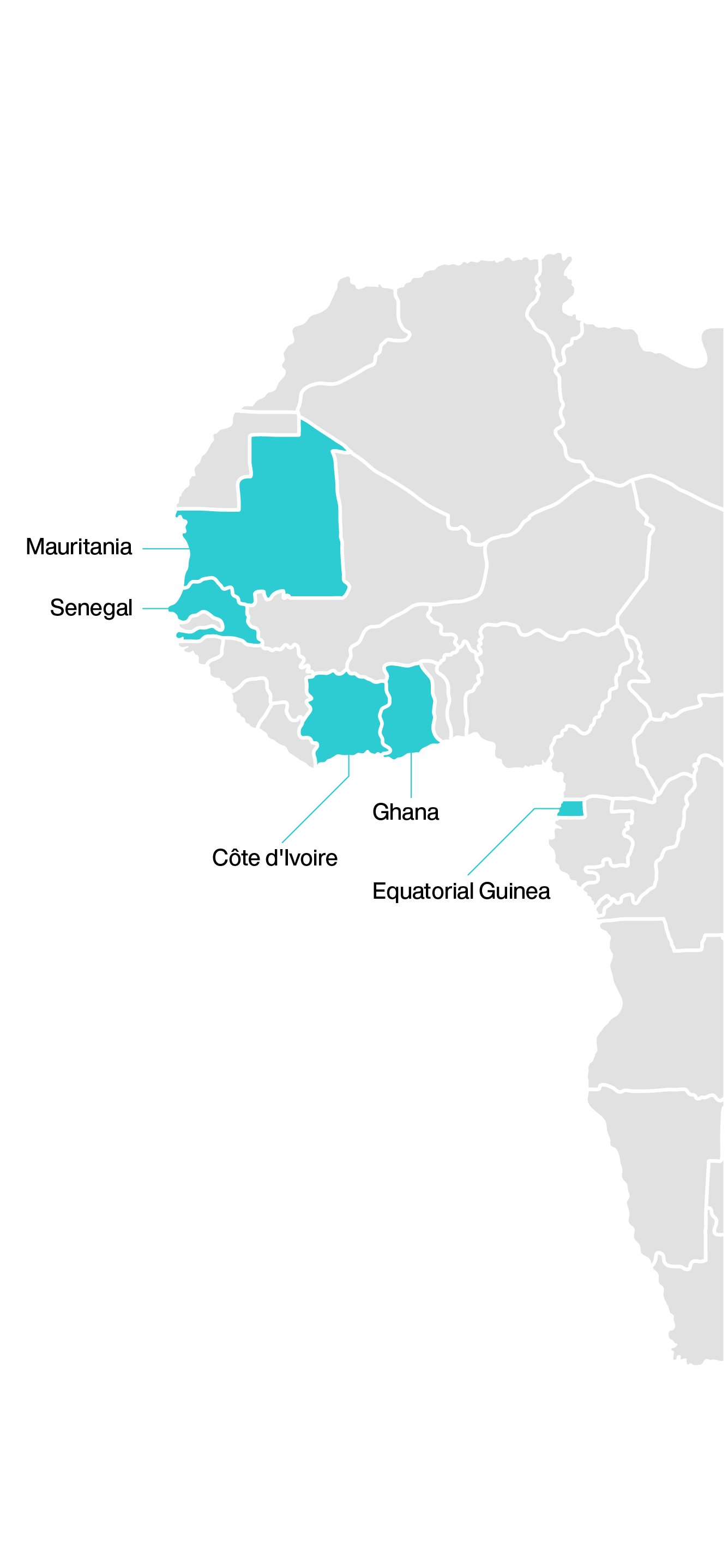

Fourth, many of our most important client relationships are with national oil companies. We understand their motivations, we respect their operating cultures, and we want to help them achieve their broader strategic goals. Today, many of these companies are focussed on building Africa’s energy future - and we want to help them do exactly that.

So, you could say that, here in West Africa, we are cherry picking the very best of Petrofac from around the world - the technical skills we perfected in the world’s most competitive and highly regulated markets, the insights we picked up from working as an operator, plus the emphasis on in-country value we are famous for.