Proven, scalable asset support

Our asset support services help you to stay smart and stay ahead, to maximise return on your asset investment.

Whether you are at the start of your operations journey, or running an ageing asset, we understand that safe, predictable performance is fundamental to your energy investment.

Years

26

operation and maintenance experience

Specialists

2500

dedicated for operations and maintenance

Assets

+100

globally provided with our asset support services

Our asset support services

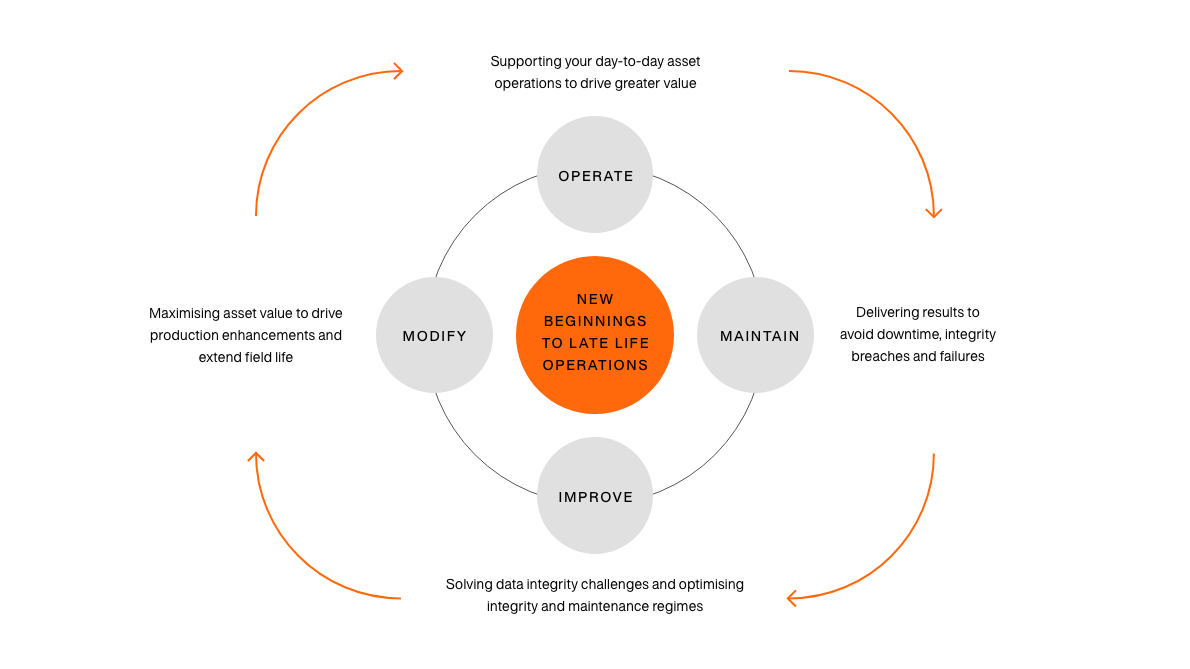

Built on three decades of operating experience, our approach to operations, maintenance and performance improvement will help you assure integrity, improve plant availability, reduce emissions and optimise energy production.

And when you want to breathe new life into your energy infrastructure, our scalable modifications model will keep things cost effective.

Optimising your balance of plant across the asset life cycle

A digital mindset

Our connected, digitally enabled teams and proven artificial intelligence solutions help predict project and equipment health, increase tool time, reduce carbon emissions and enhance site safety.

We are saving our clients millions of dollars by preventing downtime and improving worker productivity by up to 200%.

We stay agile, so you stay efficient

Whenever possible, we limit the number of people at site through our dynamic campaign approach. Not only does this benefit safety and support your net zero obligations. But it drives down cost.

By combining digital technologies, integrated planning and multi-skilled execution, we will drive ultra-efficient asset support across your infrastructure. Whether your operations are on or offshore, in the oil and gas, wind or the new energy sector.

Everything tailored to you

From standalone asset support services to integrated and fully managed models, we will develop our support to match your asset strategy.

Trust our team to bring the right energy to drive superior performance.

Talk to us